Partnering With Brilliant People, Delivering Distributions, Recruiting An Analyst & Hopefully Improving Our World

/(L-R) Evan Nisselson, Founder and General Partner at LDV Capital, speaking with Alexandre Winter, Co-Founder and CEO at Norbert Health, an LDV portfolio company. Norbert Health developed the first all-in-one ambient AI health hub. The photo was taken at LDV Capital’s Happy Hour event in July 2024 by Robert Wright.

We are thrilled to share that we have returned our LDV Capital I & II funds. We continue to have significant upside potential across each of our funds thanks to our brilliant entrepreneurs, experts, team and LP partners.

We continue investing out of our LDV Capital IV fund.

Our thesis is the same from 2012 and into the future

Our LDV Capital thesis continues to be the same since 2012 - partnering and investing in brilliant people building businesses leveraging visual technologies and AI. The majority of data our brains analyze is visual so the majority of data that AI will analyze will be visual across the light and electromagnetic spectrum. Visual data and visual technologies are critical for the success of artificial intelligence horizontally across all sectors.

Back in 2012, friends and strangers said our LDV Capital thesis-driven venture fund was “cute, niche and science fiction”. However, visual technologies are now a dinner table conversation, from generative AI to autonomous vehicles, medical imaging and much more. For example, we have been investing in businesses powered by generative AI since 2018 before this term existed. In January 2023, we wrote that generative AI as a utility will empower SaaS businesses and this has become validated.

Over the years, many have called Evan crazy for forecasting trends in visual technologies. Here’s a list of his forecasts from the keynote address he delivered at our 10th Annual LDV Vision Summit. The ones in green have been validated, and maybe the rest will be too one day.

We invest in deep tech teams at the earliest stages of businesses (pre-inc, pre-product, pre-revenue) working across all sectors including agriculture, healthcare, materials science, nanotech, logistics and manufacturing, entertainment, mobility, neuroscience, construction, optics, life sciences and biotech, advertising, video, mapping, security and much more.

We are honored to partner very early with founders of Synthesia, Clarifai, Uizard, CIONIC, Glass Imaging, Genia, Gryps, etc.

Portfolio:

LDV Capital IV: Announced our 4th fund last year.

LDV Capital I & II are returned. We continue to have significant upside potential across each of our funds thanks to our brilliant entrepreneurs, experts, team and LP partners.

LPs say we are highly differentiated, disciplined, have high-quality sourcing and successfully create value by investing in category leaders at the earliest stages.

Total investments 40, active 20, exits 11.

LDV funds are concentrated with 10-15 companies in each.

LDV graduation rate: 90% of our companies that went fundraising, have successfully raised follow-on financing.

New investments across neuroscience, synthetic biology, healthcare, ultrasound, insurance and more:

Sonus delivers advanced ultrasound for remote diagnostic imaging.

VitVio delivers real-time AI visual tracking in hospital operating theatres to increase efficiencies.

Dannce AI will increase drug efficacy & improve the lives of people with movement disorders.

Newco in the synthetic biology sector.

Newco in the insurance sector.

Reach out if you are building a startup leveraging visual technologies & AI.

Recent portfolio highlights:

Synthesia raised $180M Series C led by NEA at a $2.1B valuation.

Uizard was acquired by Miro in 2024.

Memorable AI was acquired by Reddit in 2024.

Follow-on investor partners:

Sequoia, USV, Kleiner Perkins, GV, Insight Partners, Accel, FirstMark, NEA, etc.

Platform:

90% of our investments originate from our LDV platform.

Speaker videos from our annual LDV Vision Summit since 2024.

Our 11th Annual LDV Vision Summit will be virtual on March 25, 2025. Speakers include experts from Sequoia Capital, NVIDIA, Synthesia, Kleiner Perkins, Fortune, IVP, etc.

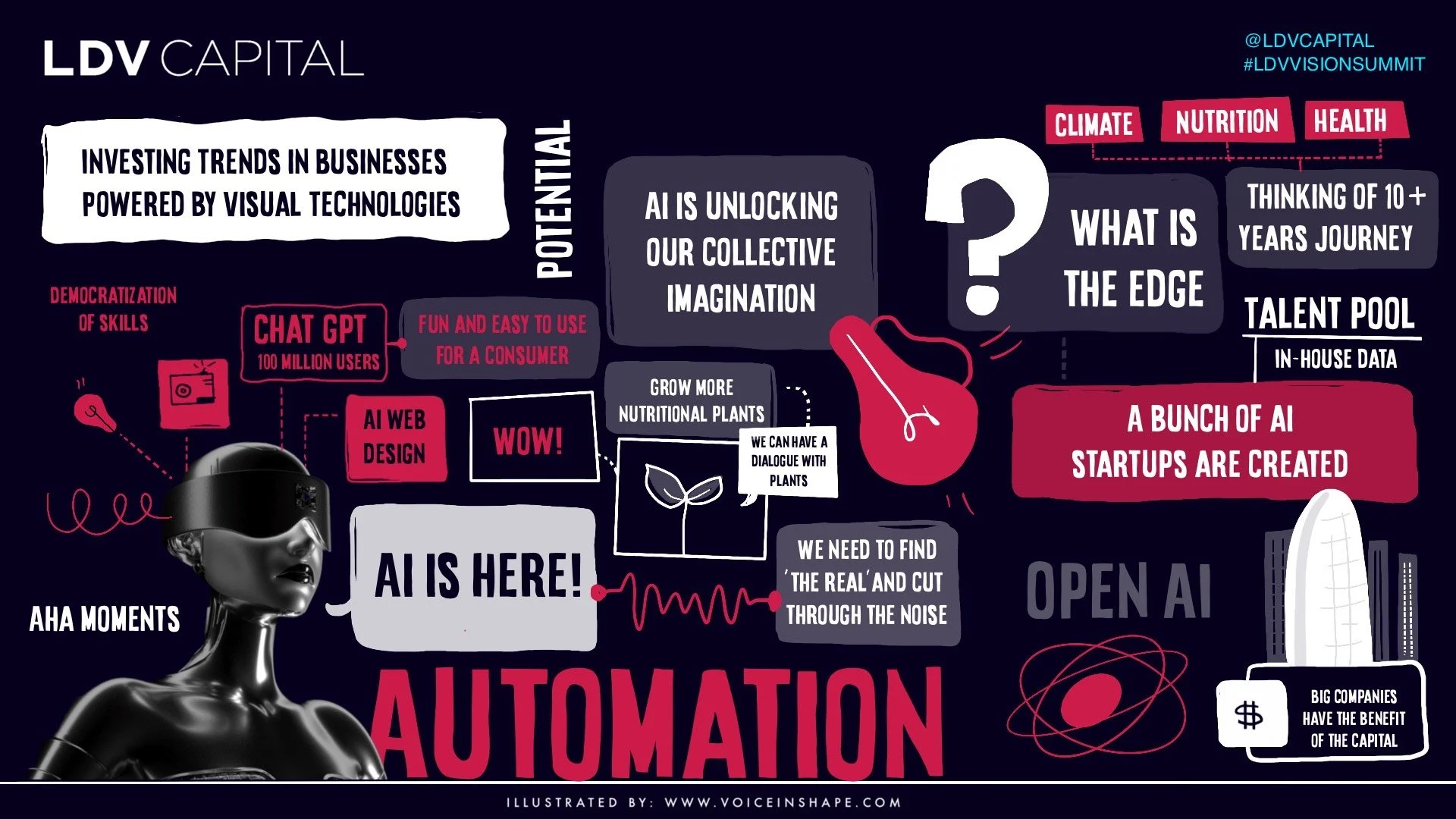

At our 10th Annual LDV Vision Summit, Evan Nisselson discussed with Sequoia Capital’s Roelof Botha trends and early-stage investment opportunities in businesses leveraging visual technologies and AI.

Top Blog Posts:

2024: 120+ Women Spearheading Advances in Visual Tech and AI

2024: To Be Successful in Business, You Have to Be Contrarian and Right

2024: LDV Capital's Annual General Meeting 2024: The Visual Tech & AI Experts Building The Future

2023: Why These 11 Brilliant Professors & Researchers Are Focusing on AI

2018: Building an MRI Scanner 60 Times Cheaper, Small Enough to Fit in an Ambulance

2015: Visual Technologies Are Revolutionizing Humanity And Business

Managing team:

We have an amazing team and we are looking for an Analyst to join our team.

Ash was promoted to Associate. Check out his reflections on three years of collaborating with brilliant deep tech entrepreneurs building businesses powered by visual tech & AI.

Kat was promoted to Head of Marketing & Content.

Max joined as an Analyst.

Join our team!

We are excited to be recruiting an Analyst to join our team to help us identify, analyze and evaluate investment opportunities. You will be a major contributor to all aspects of our fund from sourcing, market research, due diligence and supporting our portfolio companies. Apply here.

Are you building a startup and looking for investors?

It is never too early to reach out via mutual connections or here if you are building a business that leverages visual technologies and artificial intelligence.

Key Attributes of LDV:

Thesis: The Only Visual Technology & AI Venture Fund

Deep Tech Domain Expertise

Extensive Expert Network

Platform Delivers Early Access & Network Effects

We are thrilled for many more decades of partnering with brilliant people, solving huge problems, hopefully improving the world and making all of us a lot of money while we sleep!

Thank you to all of our portfolio companies, experts, investors and our fantastic LDV community!

Quotes from some of our portfolio founders:

Steffen Tjerrild, the CFO, COO & Co-Founder of Synthesia and Victor Riparbelli, Co-Founder & CEO at Synthesia, the worldwide market leader in enterprise AI video.

"Evan feels like a part of the team, much more so than any other investor I have worked with. He is always available for valuable sparring and his own entrepreneurial experience gives him a unique ability to not only understand the business challenges very well but also emphasize our personal journey.” Victor Riparbelli, Synthesia, Co-Founder & CEO.

Matthew Zeiler, Founder & CEO at Clarifai, a leader in Computer Vision AI Platforms. Clarifai's platform supports the full AI development life cycle; including dataset preparation, model training and deployment.

“As an investor Evan is accessible, knowledgeable and very hands-on when we need him. He’s been a huge help with decision making, recruiting and making introductions to clients as he is very well connected.” Matthew Zeiler, Clarifai, Founder & CEO.

Malmo, Sweden. December 17, 2014 (Left photo, R-L: Johan Gyllenspetz, Jan Erik Solem, Kamil Nikel, Peter Neubauer, Yubin Kuang, Pau Gargallo, and Evan Nisselson with backgrounds from Sweden, Norway, Germany, Poland, Spain, China and US).

“LDV Capital was our first investor in Mapillary which was acquired by Facebook in 2020,” says serial entrepreneur and computer vision expert Jan Erik Solem, a co-founder of Mapillary, an LDV Expert in Residence, and LDV investor. “They were a tremendous value-add to our Mapillary team from our first prototype to our acquisition by Facebook. Their visual technology focus, strong conviction, exceptionally strong network and hands-on collaboration make them great investors and I highly recommend them to fellow entrepreneurs.”

Tony Beltramelli, Co-Founder & CEO of Uizard (acquired by Miro), at our 5th Annual LDV Vision Summit in 2018.

“Evan has been a key asset to our business and is always ready to get his hands dirty by working closely with us whenever we need him. He doesn't just invest capital, he genuinely and deeply cares about the companies he invests in and is fully ready to help them grow.” Tony Beltramelli, Uizard, Co-Founder & CEO.

Dareen Salama, Co-Founder & CEO at Gryps, an RPA platform delivering automation to the construction industry, at one of LDV Capital’s Happy Hour events.

“Evan has the talent of transforming to be the most helpful investor across various stages of our business. He knows what we need and when we need it. I find his advice very helpful and timely. He has the perfect combination of seeing ahead into the future, advising us on the best course of action while also allowing space for us to grow and learn as first-time founders. Entrepreneurship is a lonely journey, but with the LDV team, we value their strong support and community.” Dareen Salama, Gryps, Co-Founder & CEO.

Jeremiah Robison, Founder & CEO at CIONIC, the company delivering bionic clothing for mobility impairment, at our 6th Annual LDV Vision Summit in 2019.

"In 2018, when LDV Capital invested in CIONIC, we were a one-person team with an alpha prototype of the revolutionary CIONIC Neural Sleeve and a mission to help millions of people with mobility difficulties from conditions like multiple sclerosis, stroke, cerebral palsy, and more to walk without walkers or crutches. Throughout the years, Evan and the team at LDV supported CIONIC at each stage of the process. They provide guidance on raising capital, hiring and they roll-up their sleeves to help whenever we need them for absolutely anything in order to help us succeed!" Jeremiah Robison, CIONIC, Founder & CEO.

Karin Andrea Stephan, Co-Founder & COO of Earkick, an AI-powered mental health platform with a multi-modal LLM companion.

"Evan has partnered with us from the very first day we came up with the idea of our data-driven workplace mental health monitor. We started collaborating before our company was incorporated. He and the whole LDV team are always available for us whenever we need them. They help us prepare presentations, plan KPIs, connect us to top-tier investors, provide hands-on support when things get hard and challenge us in the best way possible. Their entrepreneurial approach, big vision, strong conviction, expert guidance and hands-on execution is the best mix an early-stage company could wish for to get to the next level." Karin Andrea Stephan & Herbert Bay, Earkick, Co-Founders.

Ziv Attar, Co-Founder & CEO at Glass Imaging, at LDV Capital’s Annual General Meeting in 2024.

Sumanta Talukdar, Founder & CEO at Gardin, a cloud-based crop intelligence system leveraging AI and optical sensors, at LDV Capital’s Annual General Meeting in 2023.

"Evan is a great partner and resource for creative strategies around building business relationships, hiring and navigating fundraising. His advice is always practical and tailored to the situation, helping us make better decisions and move faster. Whether it’s refining a pitch or identifying the right opportunities, Evan’s input is super valuable and impactful." Ziv Attar, Glass Imaging, Co-Founder & CEO.

“We wanted our pre-seed lead investor to be someone who was perfectly aligned with what we are doing and equally why. Someone who knows first-hand what it’s like to be a founder, who talks directly, has extensive visual tech domain expertise, valuable platform we can leverage, helps when we ask and who rolls up their sleeves and delivers high-quality help rather than some token gesture. Evan and LDV Capital met all of these and continue to do so. If you want hard work, straight-talking and a high-quality value-add investor - Evan and the LDV team are a great choice.” Sumanta Talukdar, Gardin, Founder & CEO.